PaySend provides the international money transfer service with the lowest commission. TransferWise likewise provides an international money transfer service at a lower (compared to bank) commission.

What is better than PaySend or TransferWise?

Since these two services compete in the same niche, we, as consumers, can choose the one that is more convenient and more beneficial for us.

Comparison of PaySend and TransferWise is compiled in a summary table:

| PaySend | TransferWise | |

|---|---|---|

| To register, you need an ID | No | Yes |

| The beneficiary's bank details are required | No, the transfer is credited to the beneficiary's card | Yes |

| Instant transfer credits | Yes | No |

| Number of supported countries | Money can be sent from 49 countries to 70 countries | Money can be sent from 24 currencies to 58 countries |

| Can I transfer money from a bank card | Yes | Yes, but only with an additional commission |

| The amount of the commission | Fixed, about 1 US dollar (depending on the currency of sending) | Depends on the method of sending (bank transfer or from a card), as well as on the amount of transfer |

| Currency conversion rate | Better than WesternUnion, but worse than TransferWise | Better than WesternUnion and better than PaySend |

| First free translation | Yes (by promo code (0d8425) | Yes, when registering at this link. |

Choose PaySend or TransferWise for international transfer?

With a cursory glance at the table, it can be seen that TransferWise has more red points, that is, in the issues noted, this payment system is inferior to PaySend. But all these points are related to ease of use and speed of crediting funds.

If we take into account only the size of the actual costs of the transfer (conversion rate + commission), then TransferWise is better than PaySend.

It is recommended that you yourself check the amount credited immediately before sending.

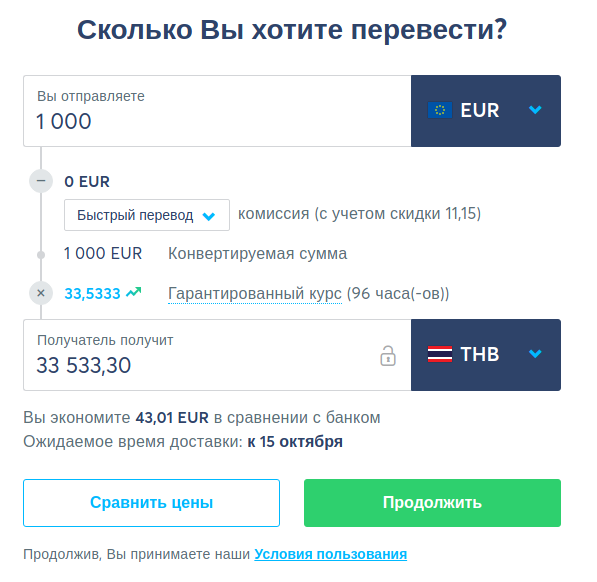

For example, when sending 1,000 euros via PaySend, I would receive 32,866 Thai Baht:

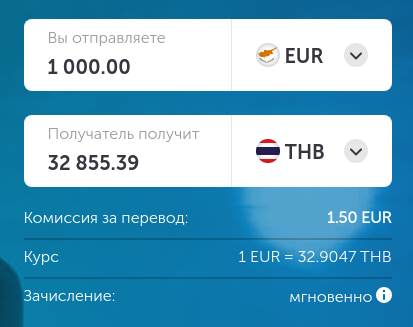

And when sending 1,000 euros through TransferWise, I would get 33,145 Thai Baht:

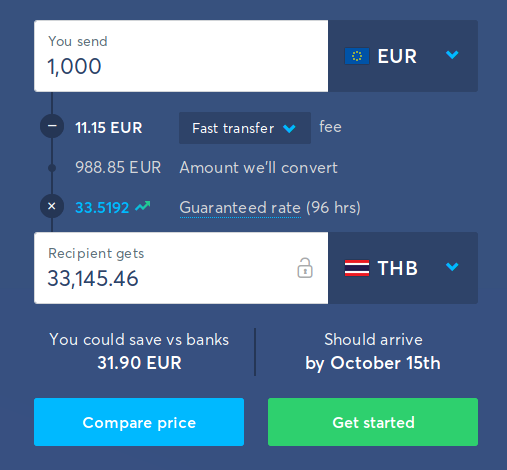

When sending the first TransferWise transfer without commission, I would receive 33,533 Thai Baht:

The difference is not very big and can fluctuate with the exchange rate or depend on a particular currency pair.

PaySend promotional code for the first free money transfer: 0d8425

Link for free money transfer in TransferWise.