There are several options for sending money to Thailand, they differ in the commission and the speed of transfer.

1. Western Union to the name of the recipient in Thailand

This transfer can be obtained instantly after being sent to any Western Union office. For sending, you only need to know the recipient data. It is enough for the recipient to present their passport (ID) and the payment code (number).

The transfer can be done at any Western Union office, or online at https://www.westernunion.com

This is the fast, most convenient, but also the most expensive way to transfer – a high commission for the transfer is included in the conversion rate. If you use the Western Union office for the transfer, you will need to pay an additional fee.

2. Western Union to a bank account in Thailand

This option is slightly cheaper than the first – thanks to a slightly more fair conversion rate. But at the same time, all the advantages of Western Union are lost: this transfer takes a long time (2-3 business days), you need to know the beneficiary's bank details.

The money will be credited to the recipient's bank account, after which he can receive it at any ATM of his bank.

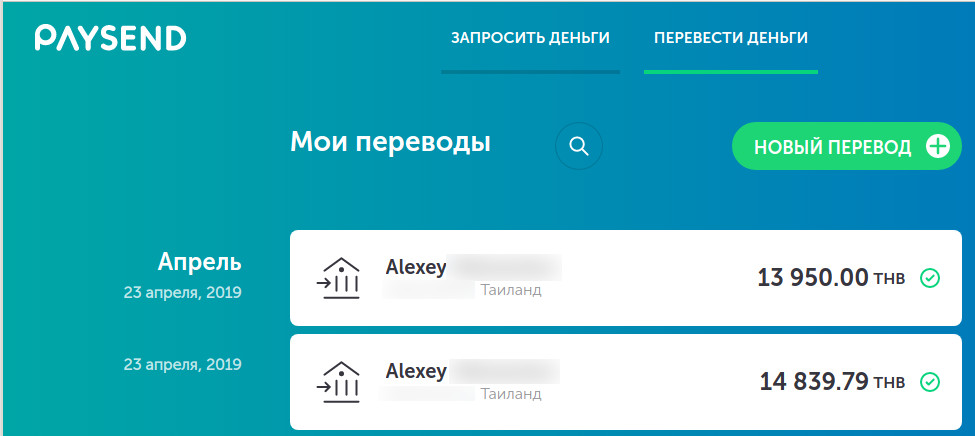

3. PaySend to Thai card

This option is a competitor for money transferring via Western Union. The transfer of PaySend to the card arrives instantly, for sending you only need to know the card number of the recipient. Payment for transferring PaySend to a card may be cheaper or more expensive than Western Union – it depends on the amount of transfer. The fact is that PaySend conversion rates are much more profitable than Western Union, but when crediting money to a card, a Thai bank charges 300 baht on any payment. The result is that if you send a small amount, then due to these 300 baht, a PaySend transfer will be unprofitable. But when transferring a large amount, thanks to the best conversion rate of PaySend, even taking into account a Thai bank commission of 300 baht, the total fee for transferring to PaySend will be lower!

PaySend website for payment: https://paysend.com, when registering, enter the invitation code 0d8425 (and the first transfer will be without commission!).

4. PaySend to an account in a Thai bank

This option is the most profitable and cheapest way to send money to Thailand! With such a transfer, the currency will be converted at the best rate, while the Thai bank will NOT charge a fee of 300 baht and even PaySend will not charge its small fixed fee.

For such a transfer, you must know the name of the Thai bank, the beneficiary's account number, the name and surname of the recipient. Money arrive within 1-3 business days.

Step-by-step instructions are given in the article “How to send money to Thailand without a Thai bank commission 300 baht”.